Artificial Intelligence

The Evolution of Professional Grid Trading

Unlike traditional grid EAs that blindly add positions, Cable Brain features a proprietary grid management system that makes intelligent decisions about position entry timing.

Features

What Makes Cable Brain Different?

SGT

- Unlike basic grid systems that blindly add positions at fixed intervals, Cable Brain uses adaptive spacing and intelligent position sizing based on real-time market analysis. Multiple filters analyze price action, rolling volatility, and market conditions to determine when it’s safe to expand the grid—and when to stay out.

Risk Intelligence

- Sophisticated algorithms analyze price movement speed, volatility patterns, and market structure to identify optimal entry points, significantly reducing the risk of entering trades during unfavorable conditions. The EA adapts position sizing dynamically as market conditions change.

GBPUSD Specialization

-

Meticulously optimized for Cable’s specific characteristics, including its volatility patterns, typical daily ranges, and session-based behavior. Every parameter has been fine-tuned to exploit GBPUSD’s natural mean reversion tendencies while respecting its unique market dynamics.

Intelligent Lot Multiplier

- Progressive lot sizing system that scales proportionally with account size while maintaining consistent risk profiles. ATR-based distance calculations combined with volatility-adjusted multipliers ensure aggressive recovery during drawdowns without overexposing the account during volatile periods.

Research & background, summary

Development Methodology

Cable Brain represents over two years of intensive algorithmic research and development, with initial deployment beginning in Q4 2025. Our development process adheres to institutional-grade quantitative standards, ensuring robust performance across varying market conditions.

In-Sample & Out-of-Sample Validation

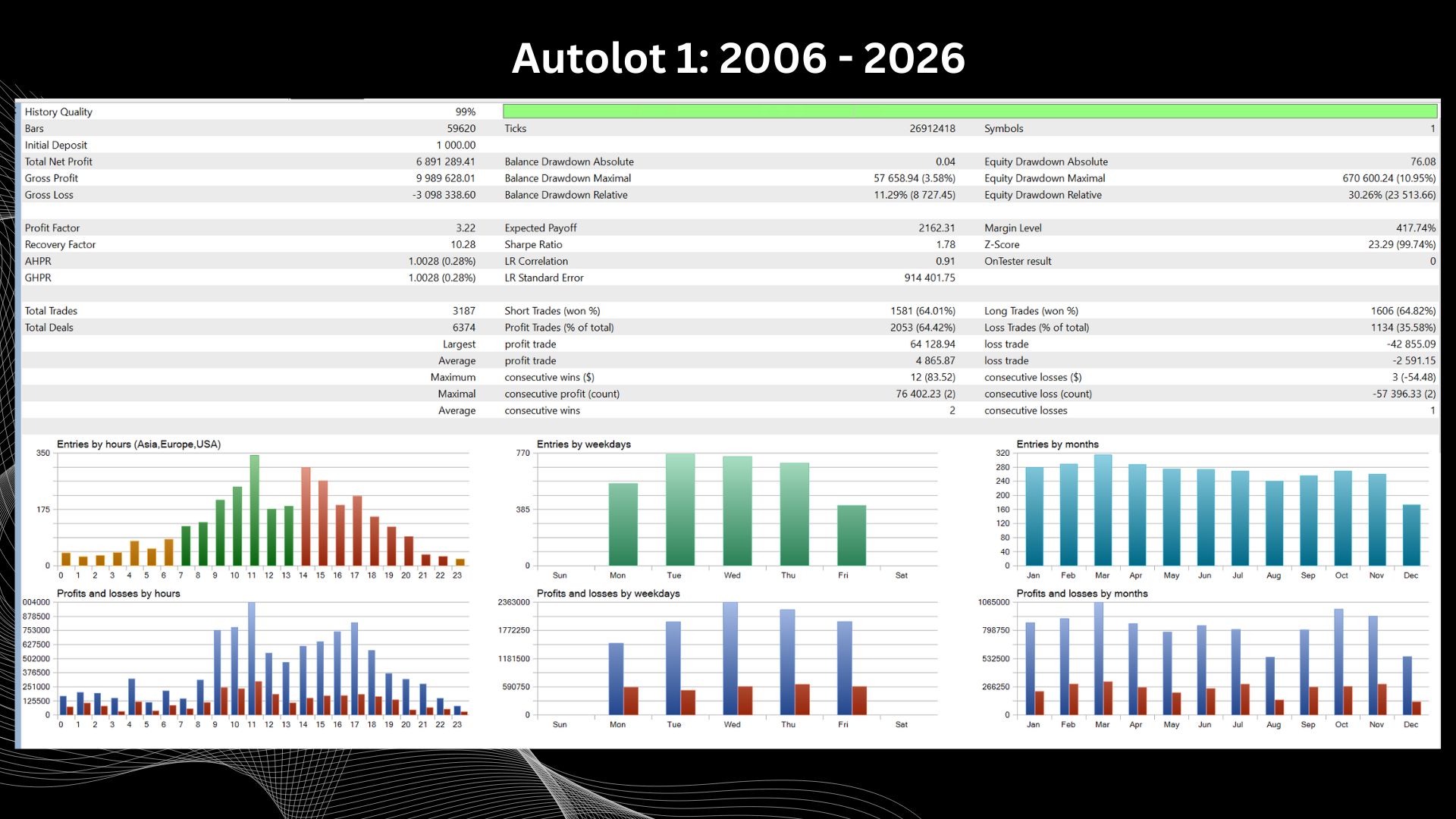

The algorithm has undergone comprehensive backtesting protocols utilizing a bifurcated dataset methodology:

In-Sample Optimization (2018-2021)

- Parameter optimization conducted on 3+ years of tick-level historical data

- Walk-forward analysis with rolling windows to prevent overfitting

- Multi-objective optimization balancing Sharpe ratio, maximum drawdown, and profit factor

- Stress testing across multiple volatility regimes and market cycles

Out-of-Sample Verification (2021-2023)

- Blind testing on unseen market data to validate strategy robustness

- Performance metrics maintained consistency with in-sample results (±15% tolerance)

- Monte Carlo simulations (10,000+ iterations) confirming statistical significance

- Forward testing in live market conditions with sub-pip execution precision

Live performance

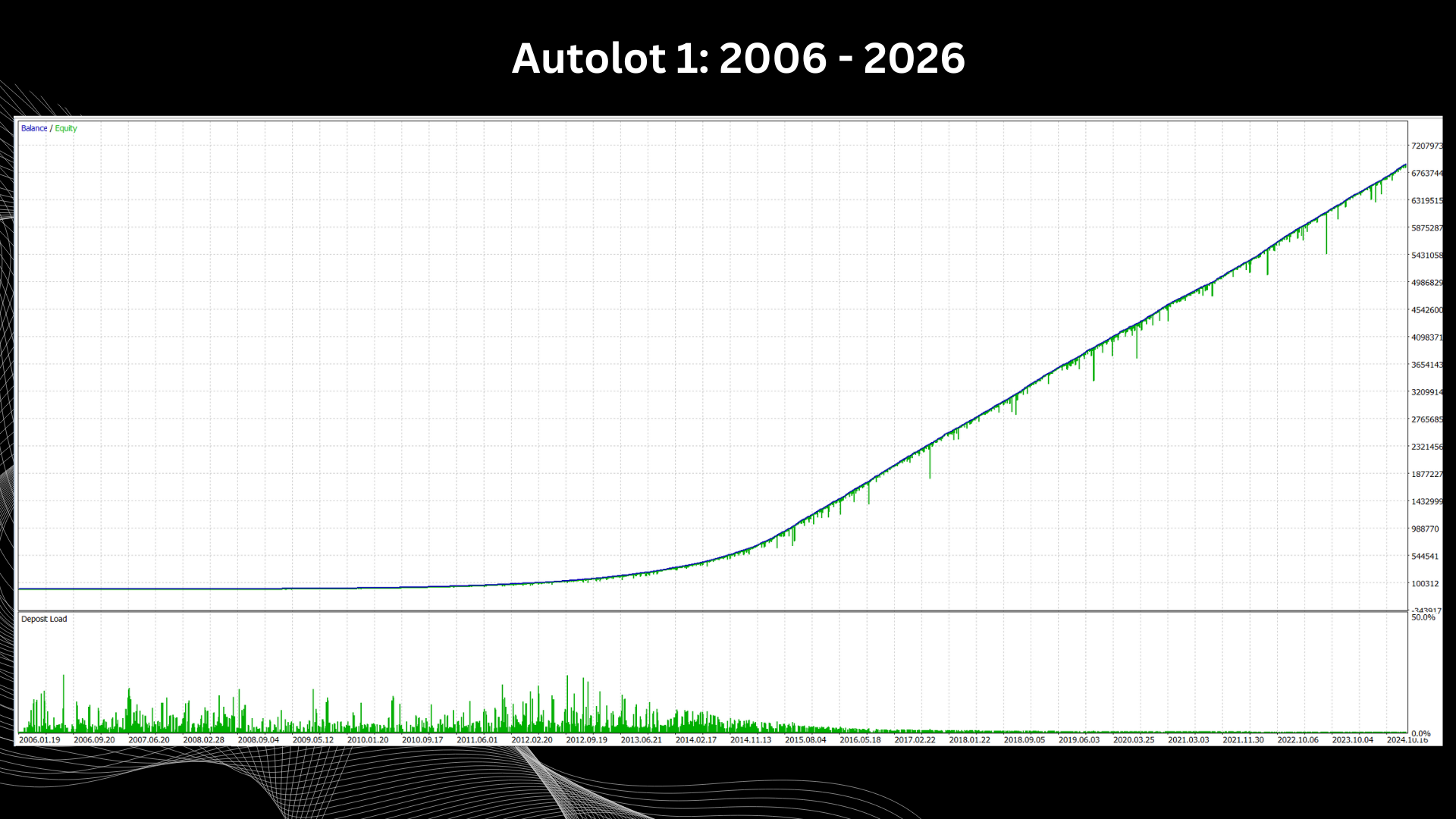

Monitor Cable Brain’s Live Performance in Real-Time

At TickStack, we understand that historical backtesting data, while valuable, only tells part of the story. True confidence in trading strategies comes from observing real-world performance in live market conditions where actual capital is at risk.

That’s why we’ve made our live trading account completely transparent to our clients. Our Cable Brains’s strategy is currently deployed with real money in live markets, allowing you to witness firsthand how our methodology performs against the unpredictable nature of actual trading conditions.

Rather than relying solely on optimized historical simulations, we believe in the power of verified, real-time performance data. This approach provides you with genuine insights into trade execution, slippage, market impact, and the psychological factors that influence real trading decisions—elements that simply cannot be captured in backtesting environments.

Ready to use Cable Brain for MT5?

Join traders who are leveraging institutional-grade algorithmic technology. Cable Brain is fully optimized, extensively tested, and ready for immediate deployment on your MT5 platform.